Why should I update my agreed value?

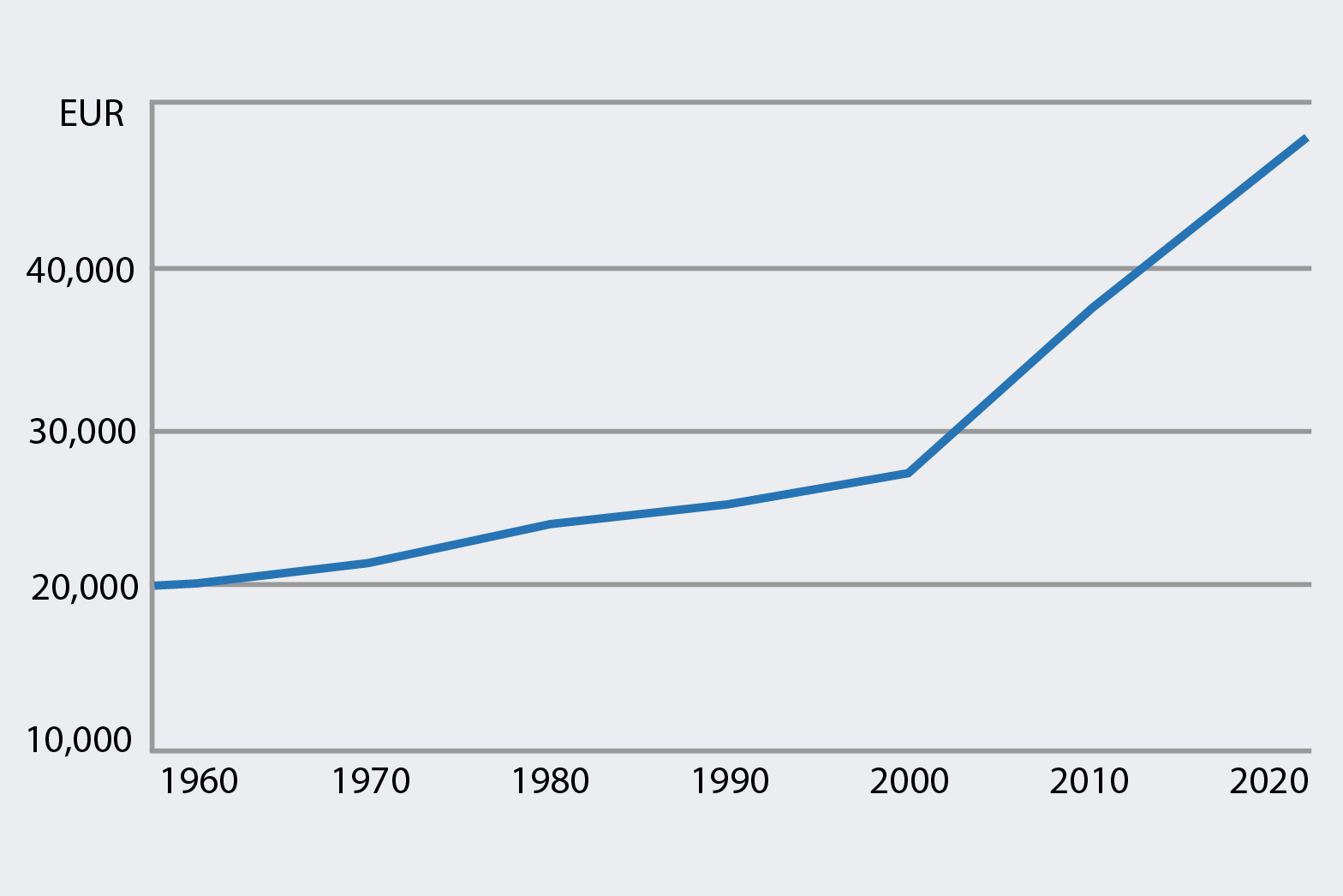

Most prices of classic cars increase annually. Does the value in your insurance contract match the actual value? If not, your vehicle is underinsured.

Many classic car owners face an unpleasant surprise in the event of damage or loss when they receive less money for their damaged car than it's worth.

Background: In the classic car sector, reimbursement is based on the "agreed value" known as "taxe" in german speaking countries. Specifically, when the contract is signed, a value is determined for the insured vehicle, usually based on an appraisal. This agreed value (and only this value) must be reimbursed by the insurance company in the event of damage or loss – even if the actual value has increased significantly due to the typical price inflation in the classic car market!

Only those who regularly update the value in between are off the hook – however, most insurance companies gladly shift this obligation to the customer as a so-called "obligation" in their terms and conditions.

With the classic-analytics Update-Service, you stay informed about the value of your vehicle for free and you avoid underinsurance.

Update your insurance now

Protect yourself from underinsurance and inform your insurance company of the current value of your vehicle - with the classic-analytics Home-Check for just EUR 49.00.

Simply fill in the online form, upload pictures, and you're done. Within one working day, you'll receive a link from us to create a valuation certificate for your insurance or vehicle documents. Payment is made via PayPal.

Of course, you can also have your vehicle evaluated directly at one of our partner offices through a Professional-Check.