How market analysis works

We hold our vehicle values to a high standard. Every value that leaves our organization must be transparent, verifiable, and substantiated, capable of withstanding any legal scrutiny. We are committed to this standard in our dealings with all of customers no matter if private individuals, insurance companies or appraisers.

If you want to do market analyzes in a reputable manner, you need to maximize your information, engage with the vintage car scene on eye level and be taken seriously as a conversational partner. You must track trends and developments, question them critically, and regularly check if the insights you gained six months ago are still current. This requires a significant investment of time, personnel, money and organization. Market analyzes cannot be conducted from the comfort of a quiet room!

Our main sources of information are:

Our main sources of information are:

Auctions

Every year, our employees visit approximately 70 international classic car auctions, with the majority taking place in the UK. For each auction, they have to inspect between 50 and 120 cars, take photos, and most importantly, assign a condition rating. This has resulted in an archive that includes around 50,000 auction results dating back to 1993. The current results, along with our photos and condition ratings, are published in the Motor Klassik magazine on a monthly basis.

Auctions have a crucial advantage for market observers: they are transparent. When the hammer falls, the winning bid must be paid – this sets them apart from all other sources of information. However, each auction is always a snapshot, and an exceptionally high or low price should not, in isolation, be a reason to change a vehicle's value.

Trade fairs

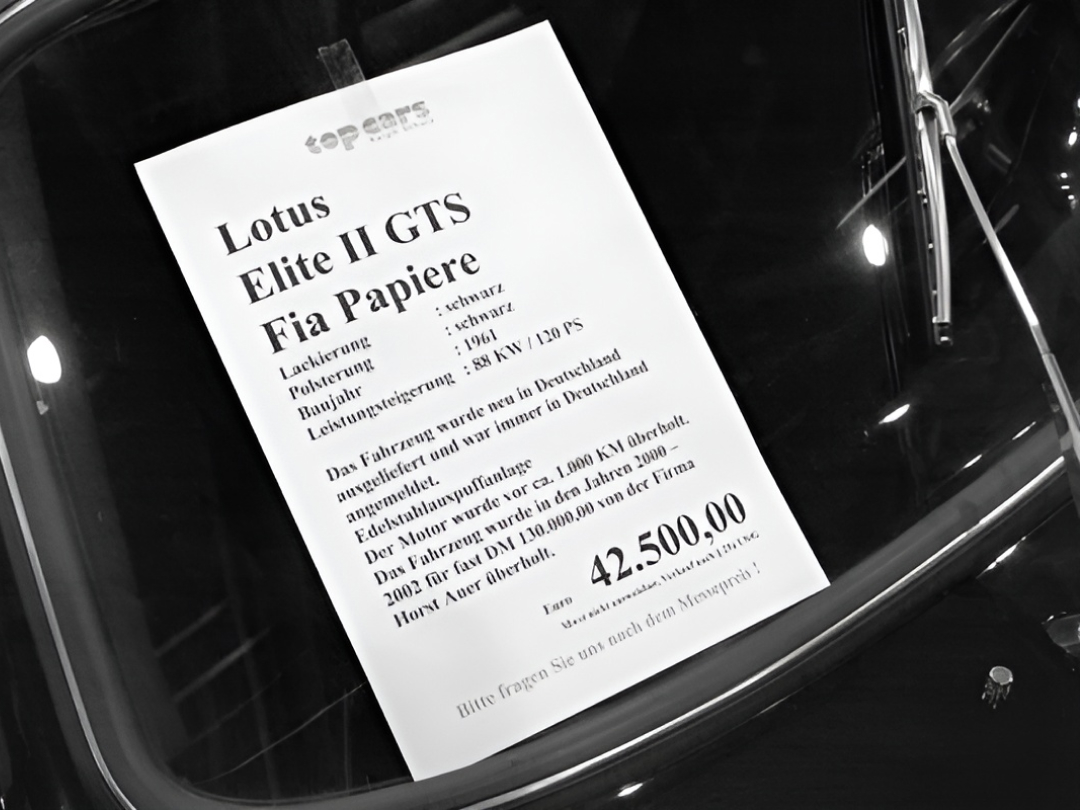

Large international trade fairs like the Techno Classica in Essen, the Auto Moto d'Epoca in Padua, or the NEC in Birmingham are interesting for market observation for several reasons. Firstly, they showcase the current (fair) price level in the dealer segment. Secondly, the structure of the vehicle offerings at these fairs can provide insights into which models or types of classic cars are currently in demand. Crowds of people gather around crowd favorites.

Dealers

Regular discussions with dealers are essential for us. Over the years, we have built a network with commercial sellers that is characterized by mutual fairness and honesty. In short, we never learn the buyer's name, but (almost) always the purchase price.

The feedback from dealers reveals not only which brands or models are currently in trend but also how the current relationship between market value and replacement value looks. The dealer selling price largely corresponds to the replacement value and includes, at least partially, costs for value-added tax, vehicle preparation, vehicle maintenance, warranty, labor costs, and rent. Therefore, it is inevitably higher than the market value.

Clubs

What applies to dealers also applies, in a broader sense, to clubs. Many vehicles, especially niche models, are primarily traded within brand- or model-specific clubs due to their limited distribution or a focused group of enthusiasts. Because we handle information responsibly, numerous clubs share sales results with us, anonymized after prior consultation with their members.

Magazines (national/international)

Monthly, we analyze around 60 international trade magazines. These include titles such as Oldtimer Markt, Motor Klassik, Classic and Sportscar, Rétroviseur, Ruoteclassiche, and Collectors Car, as well as special interest magazines like Chrom und Flammen or Opel Scene. Advertisements are electronically processed and entered into a database. This allows us to determine, among other things, whether a particular vehicle has been unsuccessfully offered for an extended period.

However, an advertisement reflects only the price that the seller deems appropriate, and sometimes there is a significant gap between expectation and reality. Therefore, we regularly follow up, call sellers, have them describe the condition, and assess their willingness to negotiate. In some cases, we or one of our valuation partners also inspect vehicles on-site.

Internet

Similar to magazines, the regular evaluation of national and international online portals is also part of our tasks. Websites like mobile.de, anamera.com, hemmings.com, or classiccarsforsale.co.uk offer tens of thousands of classic cars for sale daily. Even exotic models can often be found after a short search. However, the real work only begins after that. What is the actual condition of the vehicle? Is the selling price realistically set, or is the vehicle being offered on multiple platforms without finding any interested buyers? Those who take the easy way out and simply calculate the arithmetic mean of all offers will undoubtedly arrive at the wrong value.